Similar to the previous negligence penalty, intentional disregard has a penalty of an additional 20% of unreported or inaccurate income.įor this kind of penalty, the IRS looks for negligence that is careless or reckless.

Penalty for Negligence or Intentional Disregard For example, the IRS first forgave the taxpayer for the typo, but the taxpayer repeats the typo on the next tax return.

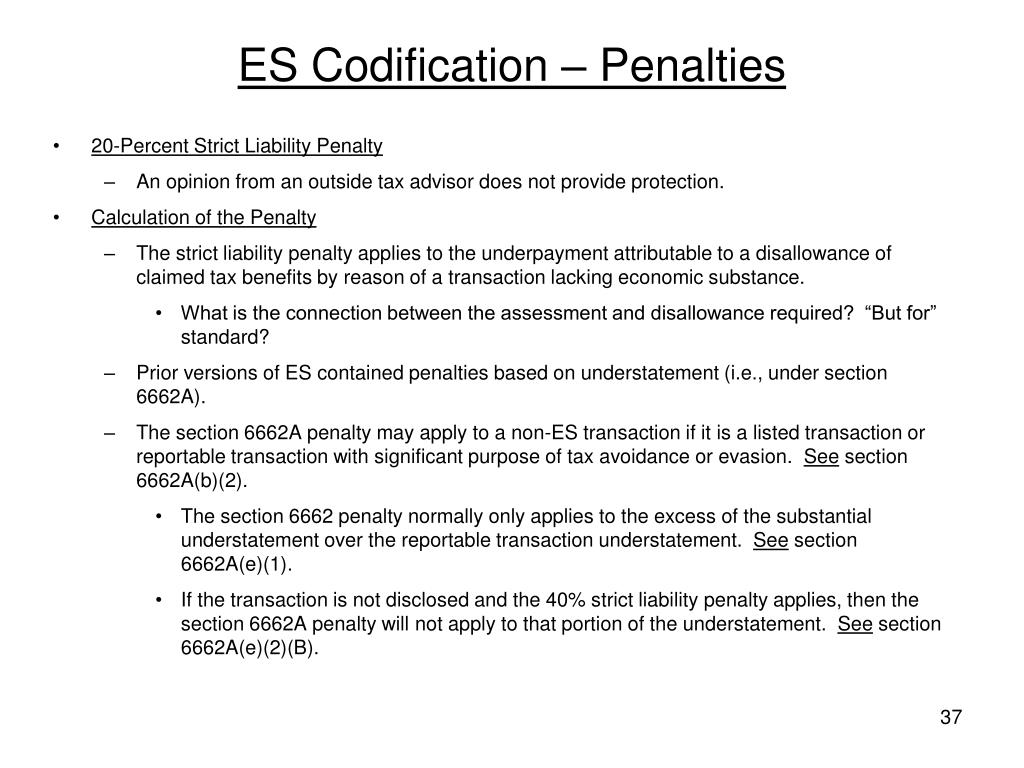

Irc 6662a code#

IRS Code Section 6662(a) explains how the IRS reached this conclusion regarding taxpayer negligence. Perhaps the most common accuracy penalty levied on taxpayers, the negligence penalty imposes an additional 20% fee on top of the unreported or underreported tax. IRS Negligence Penalty A man reviews documents while sitting in a chair. The IRS usually grants first-time penalty abatement to taxpayers who are merely negligent but not to those who have committed tax evasion or fraud. Lastly, ignorance of the law excuses no one, which can negatively affect taxpayers who just made a careless mistake with no malice or bad faith. Basically, if a taxpayer made a mistake regarding deductible expenses in their tax return for 2007 but the IRS found out after a review for the tax year 2019, then the taxpayer may raise the statute of limitations. However, the statute of limitations can protect taxpayers with its 10-year limitation. Typically, these accuracy-related penalties follow after a tax audit, but sometimes the IRS can send an amended 1040 or other tax return. These penalties can substantially increase the tax debt (with the failure to file and failure to pay penalty possibly adding an extra 50%) and can lead to harsher tax collection actions by the IRS like a tax levy or wage garnishment. Taxpayers still pay penalties like the failure to file, failure to pay penalty, and other underpayment penalties and fees. The IRS received around $1 billion from these taxpayers, revenue growth of more than 200%. In 2010, the inaccuracy penalty hit more entities and grew approximately 7 times, to more than 469,000 individuals and corporations. In 2005, the IRS levied inaccuracy penalties on more than 58,000 taxpayers for $325 million, according to legal research giant Lexis Nexis.

0 kommentar(er)

0 kommentar(er)